The unit had traded mortgages and other fixed-income assets, and during the sales process the unit changed its name from Blackstone Financial Management to BlackRock Financial Management. They agreed to part ways, and Schwarzman sold BlackRock, a decision he later called a "heroic mistake." In June 1994, Blackstone sold a mortgage-securities unit with $23 billion in assets to PNC Financial Services for $240 million. Fink wanted to share equity with new hires, to lure talent from banks, unlike Schwarzman, who did not want to further lower Blackstone's stake. In 1994, Schwarzman and Fink had an internal dispute over methods of compensation and equity. At the end of 1994, BlackRock was managing $53 billion. The firm adopted the name BlackRock, and was managing $17 billion in assets by the end of the year. Schwarzman and Fink were considering selling shares to the public. īy 1992, Blackstone had a stake equating to about 35% of the company, and Stephen A. The percent of the stake owned by Blackstone also fell to 40%, compared to Fink's staff. Within months, the business had turned profitable, and by 1989 the group's assets had quadrupled to $2.7 billion. In exchange for a 50 percent stake in the bond business, initially Blackstone gave Fink and his team a $5 million credit line. Peterson called it Blackstone Financial Management. Initially, Fink sought funding (for initial operating capital) from Pete Peterson of The Blackstone Group who believed in Fink's vision of a firm devoted to risk management. That experience was the motivation to develop what he and the others considered to be excellent risk management and fiduciary practices. During Fink's tenure, he had lost $90 million as head of First Boston. Fink, Kapito, Golub and Novick had worked together at First Boston, where Fink and his team were pioneers in the mortgage-backed securities market in the United States. Kapito, Susan Wagner, Barbara Novick, Ben Golub, Hugh Frater, Ralph Schlosstein, and Keith Anderson to provide institutional clients with asset management services from a risk management perspective. The company has also faced criticism for its close ties with the Federal Reserve during the COVID-19 pandemic and for anti-competitive practices due to its significant ownership stakes in many companies.īlackRock was founded in 1988 by Larry Fink, Robert S. states of West Virginia, Florida, and Louisiana have divested money away from or refuse to do business with the firm because of its ESG policies. Others have scrutinized BlackRock for its efforts to reduce its investments in companies that have been accused of contributing to climate change and gun violence and its promotion of gender diversity the U.S. It has been criticized by some for investing in companies that are involved in fossil fuels, the arms industry, the People's Liberation Army and human rights violations in China.

īlackRock has sought to position itself as an industry leader in environmental, social, and corporate governance (ESG). BlackRock is ranked 184th on the Fortune 500 list of the largest United States corporations by revenue.

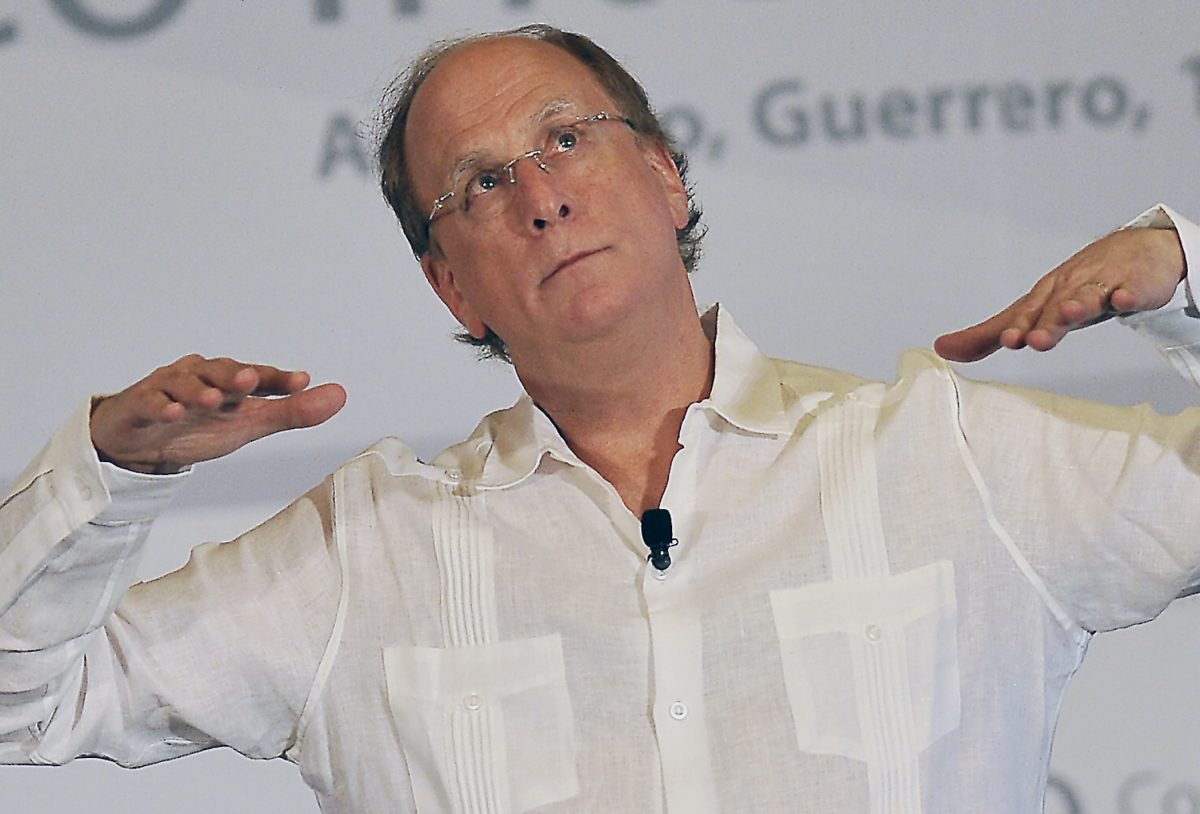

#BLACKROCK CEO LARRY FINK SOFTWARE#

Its Aladdin software keeps track of investment portfolios for many major financial institutions and its BlackRock Solutions division provides financial risk management services. BlackRock is the manager of the iShares group of exchange-traded funds, and along with The Vanguard Group and State Street, it is considered to be one of the Big Three index fund managers. BlackRock operates globally with 70 offices in 30 countries, and clients in 100 countries. Founded in 1988, initially as an enterprise risk management and fixed income institutional asset manager, BlackRock is the world's largest asset manager, with US$9.42 trillion in assets under management as of June 30, 2023. is an American multinational investment company based in New York City.

0 kommentar(er)

0 kommentar(er)